Beginner’s Guide: Investment Fees & Expenses in 2025

Understanding investment fees and expenses is crucial for beginners in 2025 to maximize returns and make informed decisions, impacting overall investment success.

Embarking on your investment journey requires understanding the landscape of fees and expenses. This Beginner’s Guide to Understanding Investment Fees and Expenses in 2025 will equip you with the knowledge to navigate these costs effectively.

Why Understanding Investment Fees Matters

Understanding investment charges is vital for all investors, but it’s especially critical for beginners. These charges can significantly impact your total overall return over time.

Ignoring investment fees means you’re essentially leaving money on the table. Knowledge of these fees empowers you to make informed choices and potentially save a considerable amount over the long term.

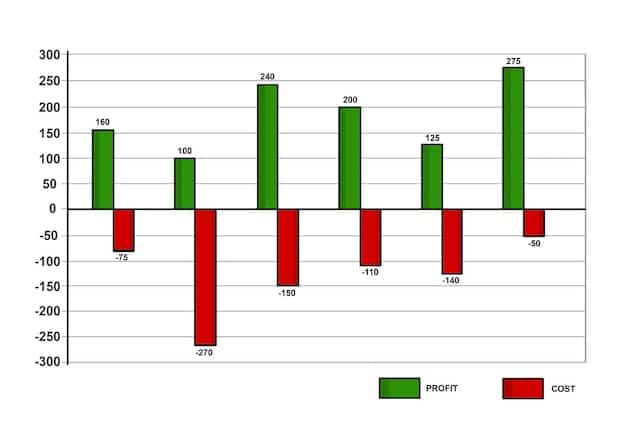

The Impact of Fees on Returns

Fees eat into your profits; therefore, the less you shell out on expenditures, the more money you can retain. It’s important to note that even seemingly small percentages can have a big implications over the long run, especially when combined with compounding interest.

Long-Term Investment Success

Lower fees contribute to bigger returns, meaning your investments have more opportunity to grow exponentially, making your financial goals way more achievable.

- Reduce hidden costs: Find out exactly what you’re being billed and the method it’s affecting your bottom line.

- Improve your investment selections: Being equipped to evaluate varied possibilities based on their fee structures will lead to greater decisions.

- Boost confidence: Grasping charges gives you greater command over your investments and your fiscal future.

In conclusion, having a grasp of investment fees and expenses is an necessary element of being an informed investor. By making the effort to learn about diverse fee versions and their effect, you may optimize returns and comfy your financial future.

Types of Investment Fees to Know

There are several types of investment fees that beginners should be aware of. Each fee type has its own characteristics that all investors should be aware of.

Let’s dive into some of the common fees: management fees, expense rates, sales loads, and transaction fees.

Management Fees

This fee covers costs directly related to the expert managing your investments. The fee is most often expressed as a percentage of the belongings under their control.

Expense Ratios

Expense ratios are usually associated with mutual funds and ETFs. These are yearly charges that cover the operational costs of the asset which come directly out of the fund’s assets.

- Check fund data: Prior to making an investment, check out the fund’s prospectus for its fee ratio.

- Think about low-fee options: In many instances, passively managed index price range usually have less costly fee ratios than actively managed funds.

- Evaluate general overall performance: Even as a low rate is desirable, do not sacrifice overall performance totally. You need to remember the fund’s historical yield and effectiveness net of expenses.

Understanding the different types of investment prices is critical for making informed funding selections. By being aware about these prices, you could better manage your funding portfolio and potentially increase your overall returns.

How to Calculate Investment Fees

Calculating investment fees can sometimes seem daunting, but it is important to understand exactly what’s being charged.

In this section, we’ll walk through the steps of calculating these fees and provide some examples.

Calculating Management Fees

To calculate management fees, multiply the assets under management by the management fee percentage. For example, if you have $100,000 invested and the management fee is 1%, the annual fee would be $1,000.

Calculating Expense Ratios

Expense ratios are calculated similarly, as they are percentages of the total invested amount. So, if you have $10,000 invested in a fund with a 0.5% expense ratio, the annual cost would be $50.

You can also compare the fees of multiple funds. By knowing the fees, you gain a greater understanding of how much your investments are truly costing.

- Utilize fee calculators: Many online calculators and spreadsheets are to be had to help calculate funding fees, enabling you to input precise numbers and see the effects quickly.

- Read fund documentation: Evaluation of funds for fee disclosures can provide perception into how fees are calculated and carried out.

- Seek professional advice: Financial experts can guide you in interpreting and calculating funding expenses based on your specific conditions.

In conclusion, calculating funding fees is an essential step in efficiently managing your investments. Through understanding of how to calculate those fees, traders can make knowledgeable selections and optimize their investment portfolio for max returns.

The Impact of Hidden Fees

Hidden fees can eat into your investment returns without you even realizing it. Identifying these fees is key to protecting your investments.

These fees, often buried deep within fund prospectuses, may include account maintenance fees, inactivity fees, or other administrative charges.

Common Hidden Fees

One common hidden fee is the 12b-1 fee, which covers marketing and distribution costs for a fund. Another is the spread, which is the difference between the buying and selling price of an asset.

Strategies to Avoid Hidden Fees

To avoid hidden fees, carefully review all documentation before investing. Ask your financial advisor to explain any fees that are unclear.

Look for investment options with less complicated fee structures. Some brokerages offer transparent, all-in-one charges that make it easier to understand what you’re paying.

- Read the fine print: Completely review investment files and agreements to pick out any hidden charges earlier than making any decisions

- Inquire about expenses: Do not hesitate to ask monetary advisors or fund managers for a breakup of prices and any related expenses.

- Pick obvious rate structures: While possible, select investments which have easy and transparent rate structures that are easily understood.

In summary, being proactive in identifying and avoiding hidden fees is important for optimizing funding returns. By doing so, you may be confident that you are preserving more of your profits and constructing a more stable financial future.

Negotiating Investment Fees

Negotiating investment fees may seem like an impossible task, but it’s often feasible, particularly if you have a large portfolio.

Many financial advisors are willing to negotiate their fees, especially for high-net-worth clients or those who bring in significant business.

When to Negotiate

The best time to negotiate fees is when you’re first setting up your account. You can also try negotiating when your portfolio value increases or when you consolidate multiple accounts with one advisor.

Strategies for Negotiating Fees

Do your research to find out what other advisors are charging for similar services. Be prepared to walk away if your advisor is unwilling to negotiate.

Be honest about what’s important. Do you value returns over low rates or vice versa.

- Know the Market: Research and compare rates charged by similar financial advisors and investment managers in the marketplace.

- Highlight Your Value: If you have got a massive investment portfolio or capability to bring in more enterprise, leverage this to negotiate decreased costs.

- Demonstrate Loyalty: If you have got been a long-term client with a established file, use this as leverage for negotiating higher fees.

In conclusion, negotiating investment fees is a worthwhile step towards maximizing your funding returns. You may doubtlessly lower your funding prices and enhance your usual financial results by way of understanding while to negotiate, employing effective strategies, and leveraging your assets.

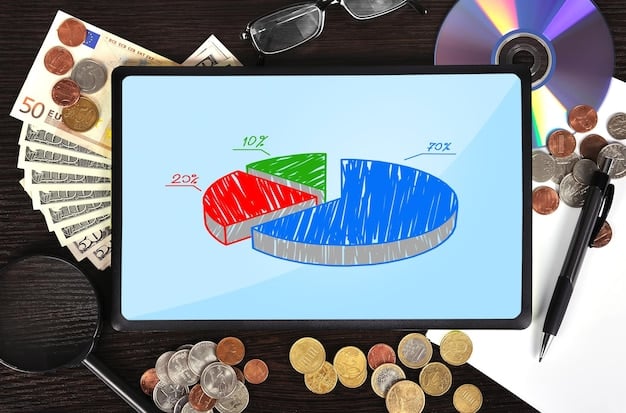

Future Trends in Investment Fees

As we look ahead to 2025, some key trends are shaping the landscape of investment fees. Technological developments and regulatory adjustments are main to new pricing fashions and improved cost transparency.

The funding industry is progressively shifting towards fee transparency as investors demand clearer and more truthful fee systems. Regulators are also enforcing tighter rules to prevent hidden charges and ensure investors understand precisely what they are paying for.

Impact of Technology on Fees

Robo-advisors, powered through algorithms and artificial intelligence, are gaining popularity for their low-fee structures. These platforms offer computerized investment control at a fraction of the price of conventional financial advisors.

Regulatory Changes

New policies aimed at improving cost transparency are expected to come into effect. The policies require funding firms to provide greater distinct fee disclosures, allowing investors to evaluate prices better and make informed choices.

- Elevated transparency: Assume more detailed and standardized fee disclosures via financial establishments

- Growth of fee-based advisory: An increasing number of advisors may also switch to fee-based fashions, aligning their pastimes with those of their clients

- More scrutiny of hidden expenses: Expect regulatory bodies to enforce stricter rules on hidden prices and deceptive pricing practices.

In summary, the future of investment prices is possibly to be formed by improvements in transparency, technology, and regulatory adjustments. Keeping informed about these traits enables investors to navigate the financial landscape with confidence and optimize their investment returns.

| Key Point | Brief Description |

|---|---|

| 💡Understanding Fees | Critical for maximizing investment returns. |

| 💰Management Fees | Covers costs of managing investments, based on assets. |

| 🔍Hidden Fees | Can erode returns; review documents carefully. |

| 📈 Negotiating Fees | Often possible with larger portfolios or new accounts. |

FAQ

▼

The main types of investment fees include management fees, expense ratios, transaction fees, and sales loads, each impacting investment returns differently.

▼

Expense ratios are annual fees that cover a fund’s operational costs, deducted directly from the fund’s assets, reducing overall returns.

▼

Hidden fees are charges not immediately obvious, such as account maintenance, inactivity, or 12b-1 fees, impacting overall investment costs.

▼

Yes, negotiating investment fees is often possible, particularly with larger portfolios or when establishing a new account with a financial advisor.

▼

Technology, like robo-advisors, is lowering fees by automating investment management at a fraction of the cost of traditional advisors.

Conclusion

Understanding and managing investment fees and expenses is crucial for beginners looking to optimize their investment returns in 2025. By staying informed and proactive, investors can confidently navigate the world of finance and secure their financial future.