Dollar-Cost Averaging: A Beginner’s Guide for 2025 Investing

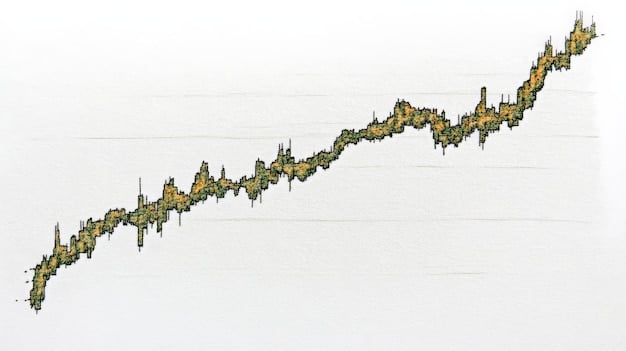

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset’s price, which can help beginner investors in 2025 mitigate risk and navigate market volatility.

Are you new to investing and feeling overwhelmed by market fluctuations? Dollar-cost averaging might be the strategy you need to ease your entry into the world of investments in 2025.

What is Dollar-Cost Averaging?

Dollar-cost averaging (DCA) is a simple, yet effective, investment strategy. It’s especially appealing to beginner investors because it can help reduce the stress of timing the market.

Instead of trying to guess when the market is at its lowest, you invest a fixed amount of money at regular intervals, regardless of the asset’s price. This approach can help you buy more shares when prices are low and fewer shares when prices are high.

The Core Concept of DCA

At its core, DCA is about consistency and discipline. It’s a systematic approach to investing that removes the emotional element of trying to time the market.

By investing regularly, you’re essentially averaging out the cost of your investment over time. This can lead to better returns in the long run, especially in volatile markets.

How DCA Works in Practice

Imagine you decide to invest $500 per month in an S&P 500 index fund. If the price of the fund is $100 per share one month, you’ll buy 5 shares. If the price drops to $50 per share the next month, you’ll buy 10 shares. When the price goes up to $125 per share, you will get 4 shares. Over time, your average cost per share could be lower than if you had invested a lump sum at the beginning.

- Consistency: Regular investments at set intervals.

- Fixed Amount: Investing the same dollar amount each time.

- Averaging: Reducing the impact of market volatility on your overall cost.

In conclusion, dollar-cost averaging is a strategy designed to make investing more manageable, especially for beginners in 2025. It helps to level out the purchase price of assets over time and reduces the risk associated with trying to time the market perfectly.

Benefits of Dollar-Cost Averaging for Beginners in 2025

For those just starting out in the world of investing, the stock market can seem daunting. Dollar-cost averaging offers several key advantages that make it an attractive strategy for beginners in 2025.

These benefits range from emotional comfort to potentially better long-term returns, making DCA a solid foundation for any new investor’s portfolio.

Reducing Emotional Stress

One of the biggest hurdles for new investors is managing their emotions. The fear of losing money can lead to impulsive decisions and missed opportunities.

DCA helps to take the emotion out of investing. By investing regularly, you’re less likely to panic during market downturns or get overly excited during rallies.

Mitigating Market Timing Risk

Timing the market is notoriously difficult, even for experienced investors. Trying to buy at the absolute bottom and sell at the absolute top is a risky game.

DCA eliminates the need to time the market. You invest consistently, regardless of market conditions, which can lead to better long-term results.

Potential for Better Returns in Volatile Markets

Volatile markets can be scary, but they also present opportunities. DCA can help you take advantage of these opportunities by buying more shares when prices are low.

This can lead to better returns in the long run, especially if the asset appreciates in value over time. However, it’s important to note that DCA doesn’t guarantee profits or protect against losses in declining markets.

- Emotional Stability: Helps manage investment emotions.

- Risk Reduction: Mitigates the risks associated with market timing.

- Opportunity in Volatility: Allows buying more shares when prices are low.

In conclusion, dollar-cost averaging provides a structured and emotionally balanced approach to investing. For beginners in 2025, it’s a strategy that reduces stress, mitigates risk, and creates opportunities for potentially better returns, which makes it an excellent starting point for building a long-term investment portfolio.

How to Implement Dollar-Cost Averaging in 2025

Implementing dollar-cost averaging is straightforward, but it requires a plan and consistent execution. Setting up a successful DCA strategy involves a few key steps.

From choosing the right investments to automating your contributions, these steps will help ensure your DCA strategy is effective and sustainable.

Choosing the Right Investments

The first step is to decide what to invest in. Common choices for DCA include stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Consider your risk tolerance and investment goals when making your selection. For beginners, low-cost index funds or ETFs that track a broad market index like the S&P 500 can be a good starting point.

Setting a Budget and Schedule

Next, determine how much you can afford to invest regularly and how often you want to invest. It’s important to set a budget that you can stick to, even during tough times.

A common schedule is to invest monthly, but you could also choose to invest weekly or quarterly, depending on your preferences and cash flow.

Automating Your Investments

To make DCA as easy as possible, consider automating your investments. Most brokerages allow you to set up automatic transfers and purchases.

This ensures that you invest consistently, even when you’re busy or tempted to skip a month. Automation is key to staying disciplined and maximizing the benefits of DCA.

- Investment Selection: Choose suitable assets like ETFs or mutual funds.

- Budgeting: Set a realistic and sustainable investment amount.

- Automation: Automate transfers and purchases for consistency.

In conclusion, implementing dollar-cost averaging involves careful planning and disciplined execution. By selecting the right investments, setting a budget and schedule, and automating your contributions, beginner investors in 2025 can establish an effective DCA strategy that aligns with their financial goals and risk tolerance.

Potential Drawbacks of Dollar-Cost Averaging

While dollar-cost averaging offers numerous benefits, it’s not without its potential drawbacks. Understanding these limitations is crucial for making informed investment decisions.

Being aware of the potential downsides ensures that you’re using DCA as part of a well-rounded investment strategy.

Opportunity Cost in a Rising Market

One of the main criticisms of DCA is that it can lead to lower returns in a consistently rising market. If you believe that an asset will increase in value over time, investing a lump sum upfront might be more beneficial.

With DCA, you’re delaying the full investment, which means you could miss out on potential gains. However, this strategy is more about risk management than maximizing returns in the short term.

Not Ideal for All Market Conditions

DCA works best in volatile markets where prices fluctuate. In a steadily declining market, DCA can help reduce losses, but it won’t prevent them entirely.

Additionally, in a sideways market with little price movement, the benefits of DCA may be minimal compared to other investment strategies.

Requires Discipline and Patience

DCA is a long-term strategy that requires discipline and patience. It can be tempting to abandon your investment plan during market downturns or to chase after quick profits.

However, consistency is key to realizing the benefits of DCA. Investors need to be prepared to stick to their plan, even when it’s challenging.

- Rising Market Missed Gains: Potential for lower returns in a consistently rising market.

- Market Condition Limitations: Less effective in steadily declining or sideways markets.

- Discipline Required: Needs long-term commitment and patience.

To summarize, while dollar-cost averaging is a valuable strategy for many investors, it has potential drawbacks. These include the opportunity cost in rising markets, limitations in certain market conditions, and the requirement for discipline and patience. By understanding these disadvantages, beginner investors in 2025 can make more informed decisions about how DCA fits into their broader financial strategy.

Real-World Examples of Dollar-Cost Averaging

To better understand how dollar-cost averaging works in practice, let’s look at a few real-world examples. These scenarios illustrate how DCA can play out in different market conditions.

These practical examples will help you visualize the potential outcomes and benefits of using DCA in your investment strategy.

Investing in a Tech Stock

Suppose an investor decides to use DCA to invest in a tech stock that is known for its volatility. They invest $200 per month. In January, the stock is priced at $100 per share, so they can buy 2 shares. In February, the stock drops to $50 per share, so they are able to purchase 4 shares. Then, in March, the price rises to $80, and they can get 2.5 shares. After three months, the investor has 8.5 shares and the average cost per share is approximately $70.59.

This demonstrates how DCA allows the investor to accumulate more shares when prices are lower, which can lead to better returns when the stock price eventually recovers.

Investing in a Bond Fund

Consider another investor using DCA to invest in a bond fund, aiming for stability and income. They invest $300 per quarter. The bond fund’s price remains relatively steady, hovering around $10 per unit. Nevertheless, throughout the year, the investor consistently adds to their investment, gradually increasing their total units in the fund.

By continuing to invest regularly, investors can make some small gains from any price fluctuations, as well as increasing profit through dividends.

The Impact of DCA During a Market Correction

During a market correction, the majority of stocks or assets go down – people panic and sell, and prices plummet. DCA can be helpful. For example, an investor chooses to invest $500 a month in an index fund, which tracks the S&P 500. Before the correction, the fund was worth $200 per share, so they bought 2.5 shares each month. But after the correction, the share price went down to $100, so they are able to buy 5 shares instead.

The investor continues to buy more shares at lower prices during the downturn, and then they gain when the market recovers. This can lead to better long term profits.

- Tech Stock Example: Accumulating more shares during price drops.

- Bond Fund Example: Consistent growth and income generation.

- Market Correction Example: Taking advantage of downturns for future gains.

In conclusion, these examples illustrate the versatility of dollar-cost averaging across different asset types and in various market conditions. By consistently investing a fixed amount, investors can mitigate risk, take advantage of downturns, and build a solid foundation for long-term financial success, making DCA a reliable strategy for beginner investors in 2025.

Advanced Tips for Dollar-Cost Averaging in 2025

Once you’ve mastered the basics of dollar-cost averaging, there are several advanced strategies you can use to refine your approach. These tips can help you optimize your returns and manage risk even more effectively.

By incorporating these advanced techniques, you can tailor your DCA strategy to your specific financial goals and market outlook.

Rebalancing Your Portfolio

Over time, the asset allocation in your portfolio may drift away from your target allocation due to market movements. Rebalancing involves selling some assets that have performed well and buying more of those that have underperformed to bring your portfolio back into alignment.

Rebalancing can help you maintain your desired risk level and potentially improve your returns over the long term.

Tax-Loss Harvesting with DCA

Tax-loss harvesting is a strategy that involves selling investments that have lost value to offset capital gains taxes. You can use DCA in conjunction with tax-loss harvesting by regularly buying assets and then selling losing positions to reduce your tax burden.

This can be a tax-efficient way to manage your portfolio and potentially increase your after-tax returns.

Adjusting Investment Amounts Based on Market Conditions

While the core principle of DCA is to invest a fixed amount regularly, some investors choose to adjust their investment amounts based on market conditions. For example, you might decide to invest more during market downturns and less during rallies.

However, this approach requires careful analysis and a good understanding of market dynamics, so it may not be suitable for all investors.

- Portfolio Rebalancing: Maintaining your desired asset allocation.

- Tax-Loss Harvesting: Offsetting capital gains taxes.

- Adjusting Investment Amounts: Modifying investments based on market conditions.

Overall, these advanced tips can help you enhance your dollar-cost averaging strategy and achieve better results. Portfolio rebalancing, tax-loss harvesting, and adjusting investment amounts offer opportunities to refine your approach and align it with your financial objectives. By incorporating these strategies into your DCA plan, beginner investors in 2025 can take their investment game to the next level.

| Key Point | Brief Description |

|---|---|

| 💰 What is DCA? | Investing a fixed amount regularly, regardless of price. |

| 📉 Benefits for Beginners | Reduces emotional stress and mitigates market timing risk. |

| 🛠️ How to Implement | Choose investments, set a budget, and automate contributions. |

| ⚠️ Potential Drawbacks | Missed gains in rising markets and requires discipline. |

Frequently Asked Questions (FAQ)

No, dollar-cost averaging is not always the best strategy. In a consistently rising market, investing a lump sum upfront may yield higher returns. However, DCA is beneficial for risk management and emotional comfort.

The frequency of your investments can be weekly, monthly, or quarterly, depending on your financial situation and preferences. Monthly investments are a common choice, but consistency is more important than the specific interval.

Stocks, bonds, mutual funds, and ETFs are all suitable for dollar-cost averaging. Choose investments that align with your risk tolerance and investment goals. Low-cost index funds and ETFs are often recommended for beginners.

No, dollar-cost averaging cannot guarantee profits. It’s a strategy designed to mitigate risk and reduce the impact of market volatility. While it can lead to better returns in the long run, it does not protect against losses.

If the market is continuously declining, it’s important to stay disciplined and continue with your DCA strategy. While DCA cannot prevent losses, it can help reduce the overall impact and position you for potential gains when the market recovers.

Conclusion

Dollar-cost averaging is a valuable strategy for beginner investors in 2025, offering a disciplined and emotionally balanced approach to investing. By consistently investing a fixed amount at regular intervals, you can mitigate risk, take advantage of market volatility, and build a solid foundation for long-term financial success. While DCA has its limitations, it remains an effective tool for new investors looking to navigate the complexities of the stock market with confidence.